What Insurances Have Timely Filing Limits That Must Be Filed In The Year The Service Was Provided

In medical billing, time is important because of the deadlines involved. Specifically, timely filing guidelines are constant due dates that healthcare companies cannot avoid.

If you neglect to encounter these defined deadlines, you could lose some serious revenue.

Below is a tabular array of contents to aid navigate through the guide:

-

What is Timely Filing?

-

Why Does it Exist?

-

Where Tin Yous Discover Timely Filing Limits?

-

Are Insurance Companies Responsible for Accepting Your Claims?

-

Do Insurances All Accept The Same Deadlines?

-

Our Analysis of Over 200 Different Timely Filing Limits

-

What Tin can You practice to Further Reduce These Denials?

-

How Long Does information technology Take to Submit Claims?

-

Tin You lot Still Receive a Deprival When Submitting Before a Limit?

What is Timely Filing?

Every medical biller is familiar with timely filing. If you aren't, it pertains to the deadlines and/or limits set past health insurance companies. To receive payment, doctors must submit their patient'due south claims within these designated timeframes.

For example, a patient visited a doc'south office on February 20th. They accept wellness insurance Visitor ABC. Visitor ABC has ready their timely filing limit to 90 days "after the mean solar day of service."

This ways that the doctor's office has ninety days from February 20th to submit the patient'south insurance claim after the patient's visit. In this example, the last day the health insurance volition accept Company ABC's claim is May 21st.

Why Does it Exist?

Y'all could argue that these limits are unfair, especially for smaller healthcare providers. But from the insurance visitor's perspective, they ensure submission as shortly as possible. After all, the biggest insurance payers process millions of claims on a daily basis.

Timely filing deadlines make information technology easier for insurance companies to process claims. In a way, they besides help doctors receive money faster.

Where Can You Find Timely Filing Limits?

Health insurance companies publish comprehensive manuals known as provider manuals. These manuals are lengthy and incorporate a ton of information regarding their claim submission and reimbursement processes.

If an insurance visitor has a defined timely filing limit, it'southward located inside their provider manual. Pay particular attention to their claims section.

As an example, let'south take a look at how we constitute Paramount Reward's timely filing limit.

Many healthcare insurances make their provider manuals bachelor online. With a quick Google search, using the keywords "Paramount Advantage provider manual", we found the link we needed on the first folio of Google.

Having clicked on the first result, nosotros landed on Paramount's manual page located on their website. Inside the re-create on the right-hand side, the words "Paramount Advantage Transmission" is a clickable hyperlink.

We were and so redirected to a .pdf of Paramount's virtually up-to-date provider manual. At that place was only i problem. The transmission was 134 pages in length and contained an overwhelming amount of text, charts, and images. Then how could nosotros detect our objective through all of this without having to read every page?

To speed upward the process, we activated our browser's find office past pressing CTRL + F on our keyboard. We and then began typing out what nosotros wanted to find within the certificate. To find Paramount's timely filing guidelines, we typed exactly that. Equally we typed, our browser searched for the words in real-time.

As soon every bit nosotros typed the word "timely" our browser directed us to the table of contents and highlighted the "Timely Filing Guidelines" section of the manual. This was the section we needed.

By navigating through every instance of the word we were looking for we reached our targeted section. The first sentence within that section was the following, "Paramount Advantage claims must be filed 365 days from the engagement of service."

Overall, the process to observe Paramount Reward's timely filing limit took less than 5 minutes.

Are Insurance Companies Responsible for Accepting Your Claims?

The short answer is no, if you have a contract with the insurance company and do not follow their guidelines. If you're a healthcare provider, information technology's your responsibleness to understand each insurance's guidelines.

Permit'south circumvolve back to provider manuals. They almost always have a clause stating that the payer isn't responsible for late claims. This clause is generally within the same department equally their timely borderline.

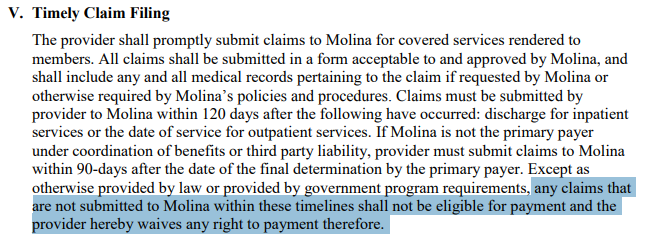

For this scenario, let's look at Molina Healthcare'due south provider manual. Past using the same procedure we used to find Paramount Advantage's guidelines we found the following clause…

In the prototype above, the highlighted phrase places responsibility on healthcare providers. If you send in a merits after the amount of time allotted, it'll come back to you as a deprival.

Do Insurances All Have The Same Deadlines?

We've already constitute the timely filing limits for ii different healthcare insurances inside this web log mail service. If you lot noticed, they were both dissimilar.

Using that aforementioned footstep-by-step process, we searched for and recorded 200 different timely filing guidelines from more than 100 dissimilar insurances. Below is a sample of our findings and a link to the sources we used to detect them.

| Healthcare Insurance | Timely Filing Limit | Source |

|---|---|---|

| Aetna | 120 days from the engagement of service | Click here |

| Humana | 180 days (physicians), 90 days (ancillary providers) | Click hither |

| Medicare | 12 months from the appointment of service | Click here |

| Tricare | 12 months from the date of service | Click here |

| United Healthcare | 90 days from the engagement of service | Click here |

| Kaiser Permanente | 12 months after the engagement of service | Click hither |

| Medical Mutual | 12 months from the date of service | Click here |

| Emblem Health | 365 days (in-network), 18 months (out-of-network) | Click here |

Our Analysis of Over 200 Different Timely Filing Limits

Subsequently recording everything, we and then decided to analyze the data we gathered and looked for commonalities.

The median amount of days yous accept to submit your claim to an insurance payer is 180.

180 days is a generous window of fourth dimension for healthcare entities of all sizes to submit their claims, right?

-

Shortest Limit: thirty days

-

91 - 119 Days: 4

-

121 - 179 Days: 1

-

181 - 364 Days: 11

-

Longest Limit: 720 days

-

Median: 180 days

-

<ninety days: ii

-

xc Days: 40

-

120 Days: xv

-

180 Days: 76

-

365 Days: 66

-

>365 Days: iv

From the bar graph and statistical data in a higher place we can conclude that…

-

The two nigh popular timeframes are 180 days and 360 days

-

In that location is a 34% chance that an insurance company has a borderline of 180 days

-

If the deadline isn't 180 days then there is a 46% take a chance that their limit is 365 days

-

If the deadline isn't 180 or 365 days and so there'southward a 56% hazard that the limit is ninety days

-

By submitting your claims within 90 days the chances that you lot receive a merits denial related to timely filing is 0.01%.

A 0.01% take a chance stacks the odds in your favor, although that percentage can however have a pregnant negative event on your bottom line if you aren't vigilant. Every bit a uncomplicated example for reference, 0.01% of $3,000,000 is $thirty,000.

Furthermore, that percent is but truthful if you lot have all of those payers and submit an equal amount of claims to each. With a small amount of extra effort, you can lower your timely filing denial rate even more.

What Tin You Do To Further Reduce These Denials?

Chances are, yous and your staff already accept a ton of piece of work to consummate on a daily footing. Some of those responsibilities include patient intendance, coding, and keeping track of healthcare requirements.

Ensuring your squad is submitting patient claims on fourth dimension is another important responsibility you need to know.

At that place are hundreds of thousands of insurance options your patients tin choose from. But which are they actually using? Of grade, I'm referring to what'due south known inside the manufacture as a "payer mix."

When speaking to our clients, almost of them know their payer mix.

A payer mix is a listing of the different healthcare insurances your patients use. It's helpful in breaking down what percent of revenue comes from common insurances.

Why not use it as a guide to help place the most important timely filing limits your team should be aware of?

Knowing the deadlines of payers that attribute to most of your revenue before your patients visit your role will help your team anticipate and submit your claims faster.

On the flipside, if your team isn't familiar with the limits for the insurances the majority of your patients use, you lot're losing acquirement.

Submitting a merits by an insurance's timely filing limit will come up back to you as Claim Adjustment Reason Code (CARC) 29 and country, "The fourth dimension limit for filing has expired."

CARC 29 has a high gamble of prevention but a depression overturn rate. Just put, it has a depression gamble of appeal after you've received the deprival, thus yous lose coin.

How Long Does it Take to Submit Claims?

There are 3 primary steps involved in getting claims to a payer…

-

Coding a claim

-

Billing a claim

-

The clearinghouse transmitting a claim to the payer

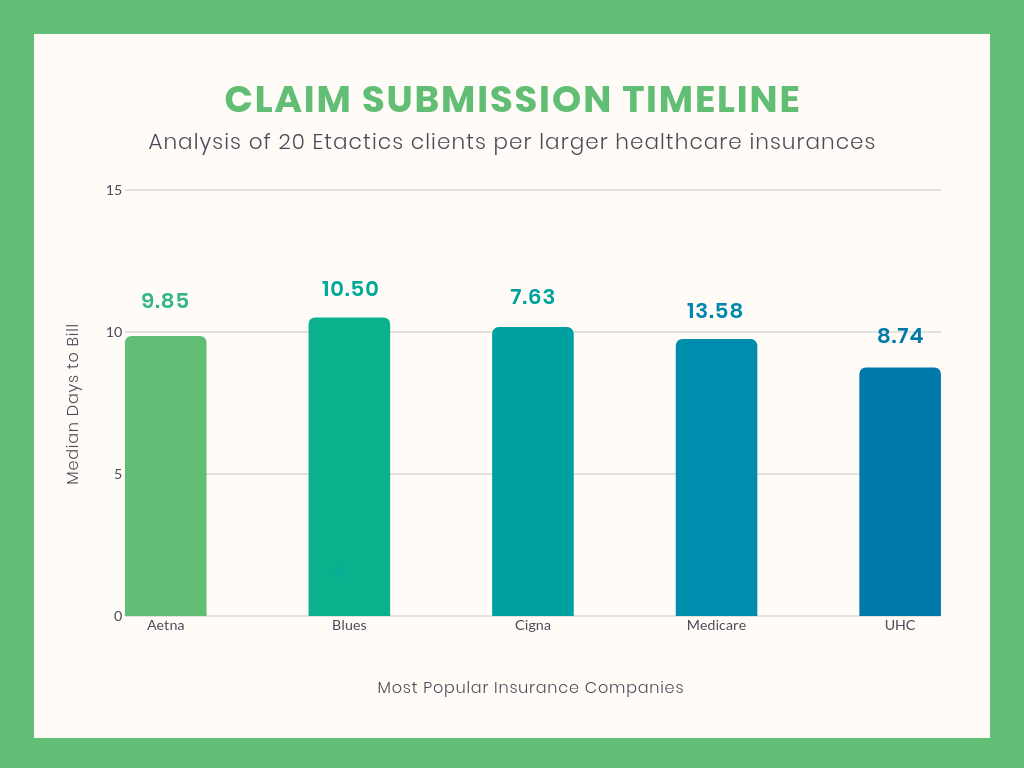

With that process in mind, nosotros looked at 20 clients that use our deprival management solution. We selected five major payers for this study, and found the median number of days from the claim's engagement of service to payer received date for each client.

Nosotros then averaged those resulting medians to obtain an "boilerplate median" number of days from the engagement of service to payer received date or "boilerplate median claims submission time."

Assay of 20 Etactics clients per larger healthcare insurances to visualize how long it takes to send a claim represented past median days to bill.

The nautical chart higher up is a visual representation of the average median days it took for our 20 clients to pecker to five of the larger healthcare insurances.

Our results determined that the average median time information technology takes for a claim to attain a given payer is ix.8 days. That'due south pretty quick!

In reality, sometimes there are claims that don't go out the door on time. Only if yous experience a delay in your claim submission, it is your responsibility to determine what happened.

Tin Y'all Still Receive a Deprival When Submitting Before a Limit?

Even if yous submit a correct claim within an insurance's borderline you can nevertheless receive CARC 29.

It is possible that the insurance provider lost or never received the claim you sent due to an error.

If this state of affairs happens, your clearinghouse should offer a timely filing study. This report lists the claim submission date to the clearinghouse and payer. Submit this report to the insurance company as an entreatment in order to overturn the timely filing denial.

Determination

There are millions of variables that come into play when dealing with merits submission and denial direction. Although timely filing limits are only a modest piece of the denial management landscape, understanding what they are, where to find them, and priorizing them based on your patient'southward most popular insurances will bring in more acquirement.

What Insurances Have Timely Filing Limits That Must Be Filed In The Year The Service Was Provided,

Source: https://etactics.com/blog/healthcare-timely-filing-guide

Posted by: singletonalreend.blogspot.com

0 Response to "What Insurances Have Timely Filing Limits That Must Be Filed In The Year The Service Was Provided"

Post a Comment