If Trends Of 2015 Continue, What Will The Majority Of The U.s. Forest Service Budget Be Spent On?

Money Does Grow on Trees equally U.S. Forest Product Exports Set Record

Link to report:

![]() Printer-friendly PDF

Printer-friendly PDF

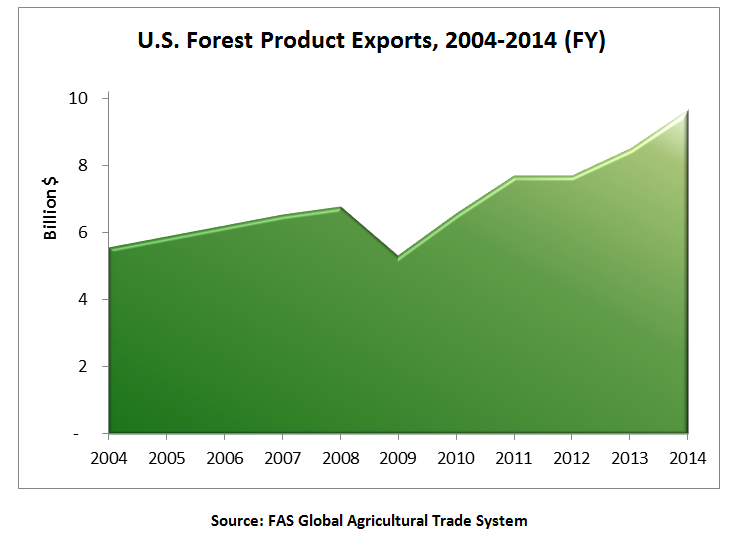

The United states exported a record $9.7 billion of forest products in fiscal yr 2014. Among U.S. agricultural exports, only corn and soybeans had higher export values. Equally the earth's quaternary-largest exporter of forest products (behind the European Union, Cathay, and Canada), the The states maintains a steady share of the growing global market at only over ten per centum.

U.S. forest product exports have grown 80 percentage over the last five years. The majority of this growth was due to growth in book, every bit prices have remained relatively flat. Despite the growth in export volume, U.South. timber stocks (uncut trees in the wood) accept experienced net growth for the last 50 years as new growth is now much higher than the harvest charge per unit.

The overall steady growth of U.S. forest product exports has been fueled by rapid growth in hardwood lumber and softwood log exports to China.

Logs and Lumber Are Height Forest Product Exports

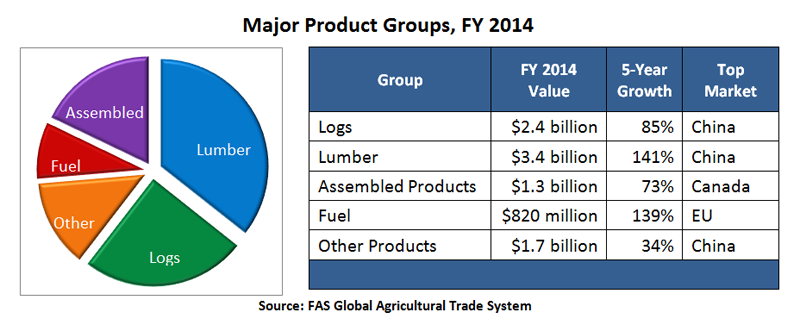

In FY 2014, total exports were up fourteen percent from the previous year, with exports in well-nigh all production groups reaching record levels. While logs and lumber represented the highest value, fuel exports – primarily in the form of wood pellets – experienced the fastest growth, mainly due to new need for renewable fuels from the Eu. Compared to other agronomical bolt, wood products are more sensitive to short-term economic move and most products saw dramatic changes in their growth trajectory following the global fiscal crisis in 2009.

Lumber: Due to significant demand for U.S. hardwood lumber, the overall value of lumber exports jumped almost 25 percent from FY 2013 to FY 2014. Hardwood lumber exports accounted for more than 70 percent of all U.S. lumber exports and realized 160-percent growth in the concluding five years. During the global financial crisis, hardwood lumber exports took a steep swoop, losing almost one-half their value. Yet, since 2009, overseas demand for hardwood lumber has recovered and exports take rebounded. The majority of contempo growth has been new volume, increasing 118 percent over the last five years to ii.eight million metric tons (MT) in FY 2014.

Logs: Log exports were brackish at the beginning of the concluding decade. Simply in FY 2009, softwood log exports began to climb, increasing past value at an average of 20 percent per twelvemonth. By FY 2014, softwood logs accounted for most three-quarters of all log exports, at a value of $ane.7 billion. Because of this sudden demand for softwood logs, prices take increased accordingly, with the growth in value almost double the growth in volume. Conversely, hardwood log exports take remained steady around $600 million for the last decade and actually decreased slightly in terms of volume.

Assembled Products: Exports of assembled products climbed steadily higher, hitting a record $ane.3 billion in FY 2014. Superlative exports included pre-fabricated wood buildings, fabricated structural members, assembled casks, door frames, and joinery products. While some assembled products may use hardwood, the majority of wood used is softwood.

Fuel (Woods Pellets and Forest Chips): In FY 2014, fuel exports reached record levels at over $800 million, an increment of almost 40 pct compared to FY 2013. While lumber and logs represent the largest value for woods product exports, fuel is clearly the fastest-growing product group, generally due to increased wood pellet exports.

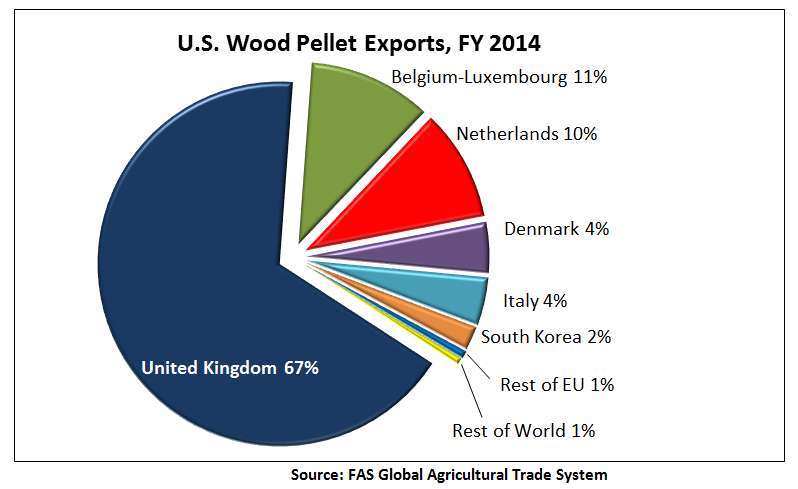

The growth in wood pellet exports is directly attributable to the European Commission's 2009 Renewable Energy Directive, which mandated that, by 2020, the Eu fulfill at least 20 per centum of its energy needs using renewable sources. (Run into U.Due south. Energy Information Administration report.) Wood pellets are generally produced from wood waste material (including sawdust, chips, and shavings) and are an important renewable fuel source that can be used for generating electricity.

In FY 2014, the United States exported 3.8 million MT of woods pellets, 97 percent of which went to the EU. Within the Eu, the United Kingdom, Belgium, and the Netherlands were the largest importers (see chart below). In FY 2014, the United States claimed a 60-percent share of the Eu wood pellet marketplace, up from 44 percent in 2013. EU demand for wood pellets is expected to go on growing, assuming individual Eu fellow member states adopt reasonable sustainability standards that will non unnecessarily impede exports from the United States or elsewhere.

Other Products: Engineered forest products include plywood, oriented strand lath, fiberboard, and particle board. While the export value of engineered products continues to rising, export growth has been slow (less than xxx percentage over the last decade). However, concerns over the safety of certain engineered wood products produced overseas may increase demand for U.S. products, which more often than not undergo more transparent and rigorous safety testing.

Milled products include veneers, flooring, moulding, and dowels. At roughly $600 meg in FY 2014, consign value has actually decreased over the past decade due to other countries' increasing capacity to mill raw logs and lumber domestically.

Other notable forest product exports include wood pulp, railroad ties, wood flour, and densified wood. Overall, these products have experienced slow consign growth.

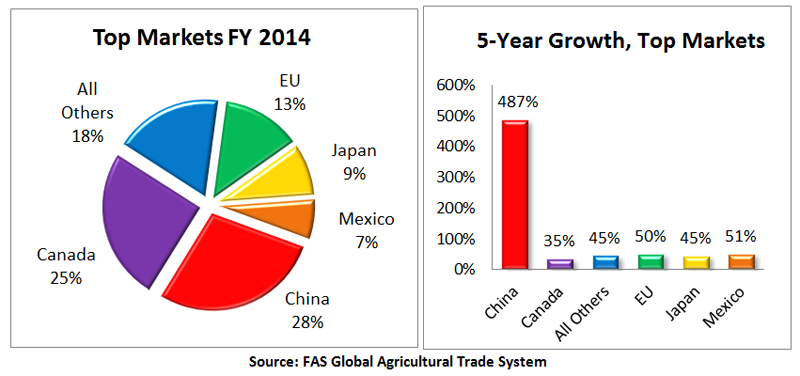

China Becomes Top Destination

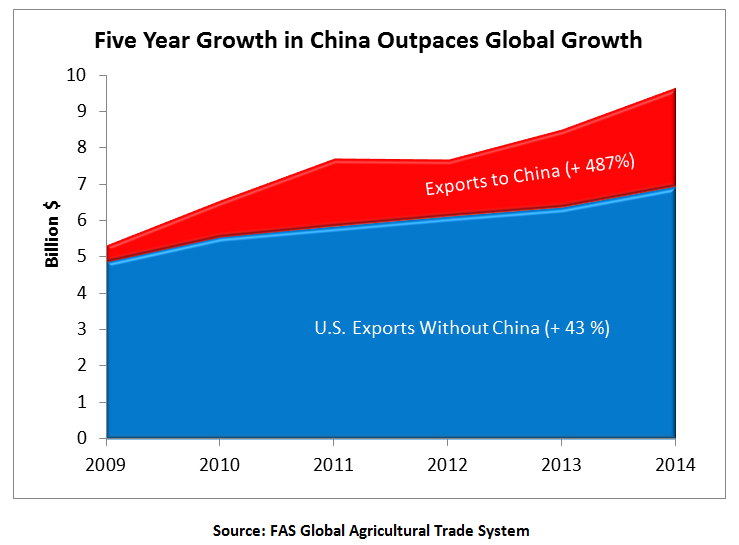

United States forest exports fix records in FY 2015 in 3 of the top five markets – Mainland china, Canada, and United mexican states. The China market experienced the greatest increase, moving into the peak position. Collectively, the height v markets (see chart beneath) make up more than 80 percentage of all U.S. forest product exports, by value. In the final five years, Canada and United mexican states both sustained steady almanac growth, realizing 35 percentage and 50 percent gains in value, respectively. While exports to the European union and Japan have also increased during the last 5 years, these markets remain well below the peaks levels reached in 1995 and 1997, respectively. Overall, it is the incredible growth from the Mainland china market that has driven the rapid increase of U.S. woods product exports.

People's republic of china'due south growth was sudden and dramatic. Prior to 2009, People's republic of china was a relatively minor market place, bookkeeping for less than five percent of U.S. forest product exports. However, since 2009, exports to China have grown almost 500 percent in value. By FY 2014, Prc became the top export destination for U.S. woods products with shipments of $ii.7 billion, bookkeeping for more than than a quarter of all U.S. woods product exports.

U.S. market share in Mainland china had previously hovered around 7 percent, but following Prc'due south sudden demand for wood imports, the U.South. industry maneuvered to have reward of this growth, virtually doubling its market place share to thirteen percent in FY 2014. In comparison, during this same time menstruation, Russian federation (the summit exporter to Cathay) saw its market place share turn down from 37 percentage to 14 per centum. If current trends continue, the U.S. is poised to overtake Russia as the top supplier of wood products to People's republic of china.

The United States' top exports to China – hardwood lumber and softwood logs – accounted for nearly three-quarters of all U.S. forest product exports in FY 2014. While hardwood lumber has always been a top U.Due south. consign to Prc, exports to China began to surge in 2009, realizing 100-percent annual growth. In FY 2014, the United States exported more $ane billion in hardwood lumber to Red china. While the majority of this growth is due to increased volume, prices have besides risen steadily (most xl percent over the final five years).

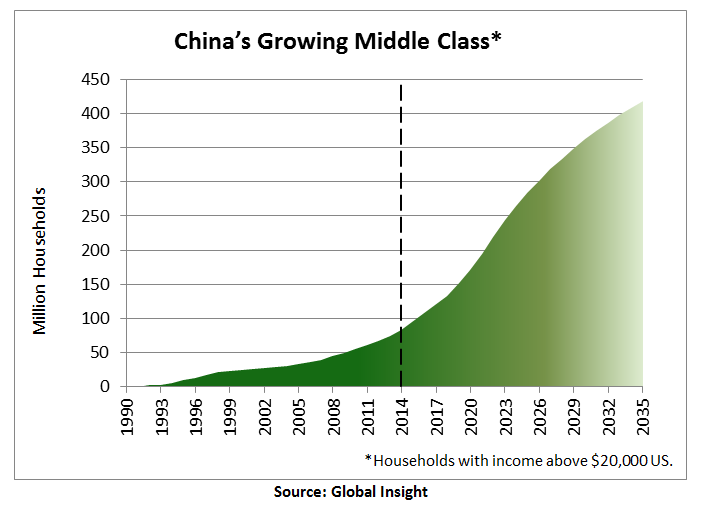

While some hardwood lumber imported by China is being processed and re-exported, information technology appears that the majority is being consumed domestically. China's current per-capita wood consumption is far beneath the world average and is expected to proceed to abound as a result of strong economic growth and a rising middle class population. Imports of hardwood logs take also increased significantly (by most 30 percent annually) in the past two years, suggesting that Chinese mills are expanding their domestic chapters to mill hardwood logs into lumber and other value-added products.

The other major U.S. export to Prc has been softwood logs. Prior to 2009, the United States exported virtually no softwood logs to People's republic of china but, since and so, softwood logs have become the 2d-largest woods product export, valued at $950 one thousand thousand. While many of these softwood logs are milled domestically and re-exported every bit furniture (China is the earth's largest article of furniture exporter), it appears that about of this wood is being consumed domestically.

If Trends Of 2015 Continue, What Will The Majority Of The U.s. Forest Service Budget Be Spent On?,

Source: https://www.fas.usda.gov/data/money-does-grow-trees-us-forest-product-exports-set-record

Posted by: singletonalreend.blogspot.com

0 Response to "If Trends Of 2015 Continue, What Will The Majority Of The U.s. Forest Service Budget Be Spent On?"

Post a Comment